43 intentionally defective grantor trust diagram

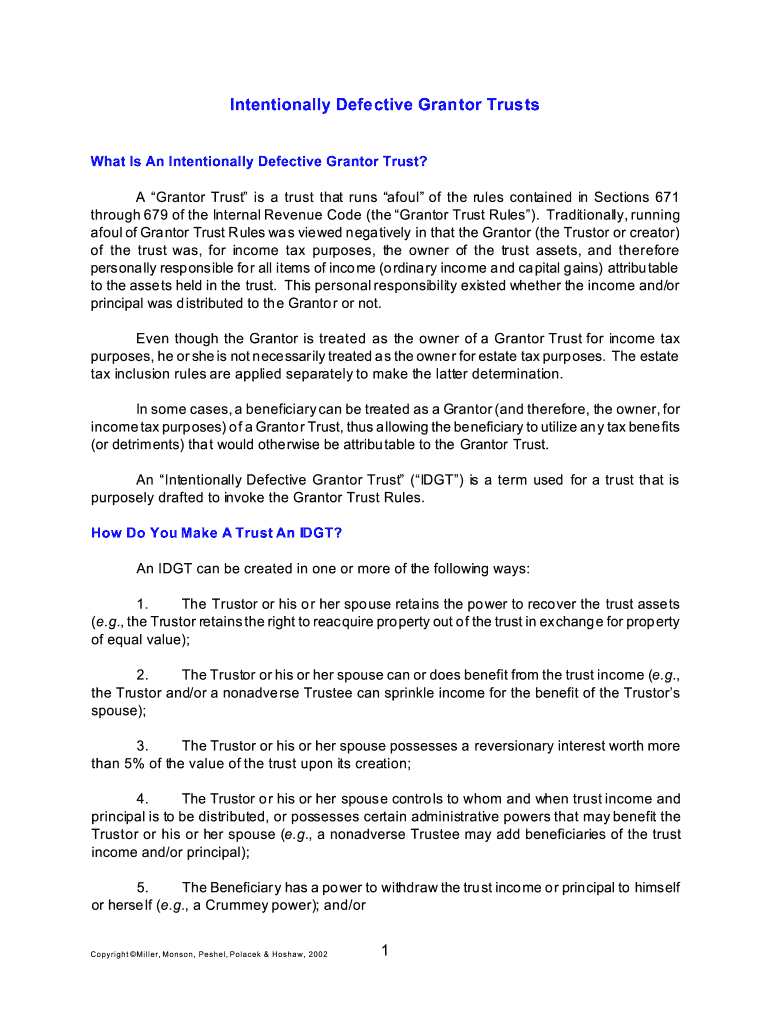

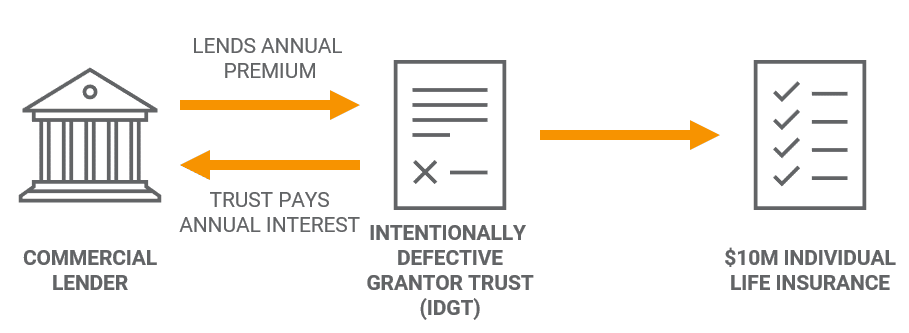

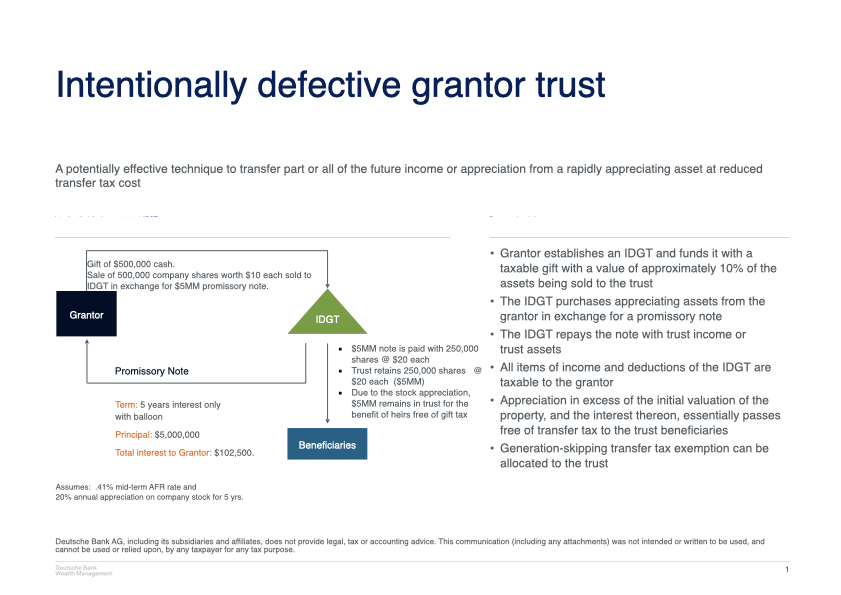

PDF Intentionally Defective Grantor Trusts called an "Intentionally Defective Grantor Trust" • Name came about because a "defect" in the trust causes its income to be taxed to the grantor (apparently an outcome many think should be avoided) • The actual IRS term used to refer to such a trust is "grantor trust." 6 . PDF Sales to Intentionally Defective Grantor Trusts (IDGT) electing small business trust. The Powers that Create a "Defective" Grantor Trust The following is a summary of the most common powers included in an IDGT that cause the trust to be classified as a "grantor" trust for income tax purposes, but will not result in the assets of the trust being included in the grantor's estate.

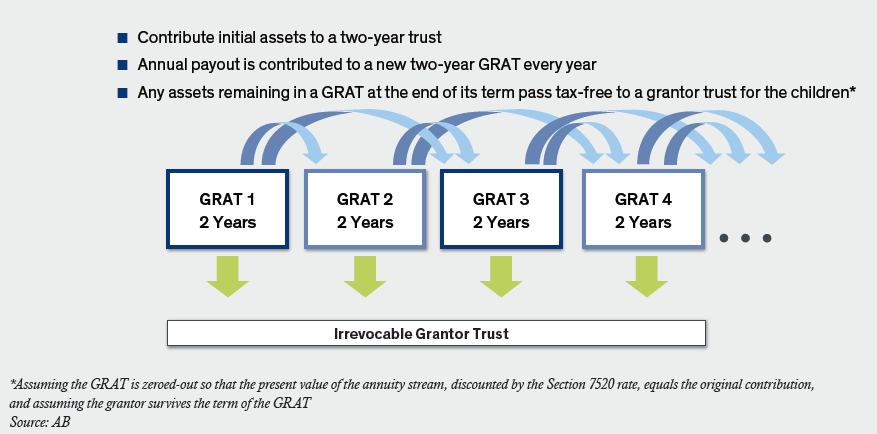

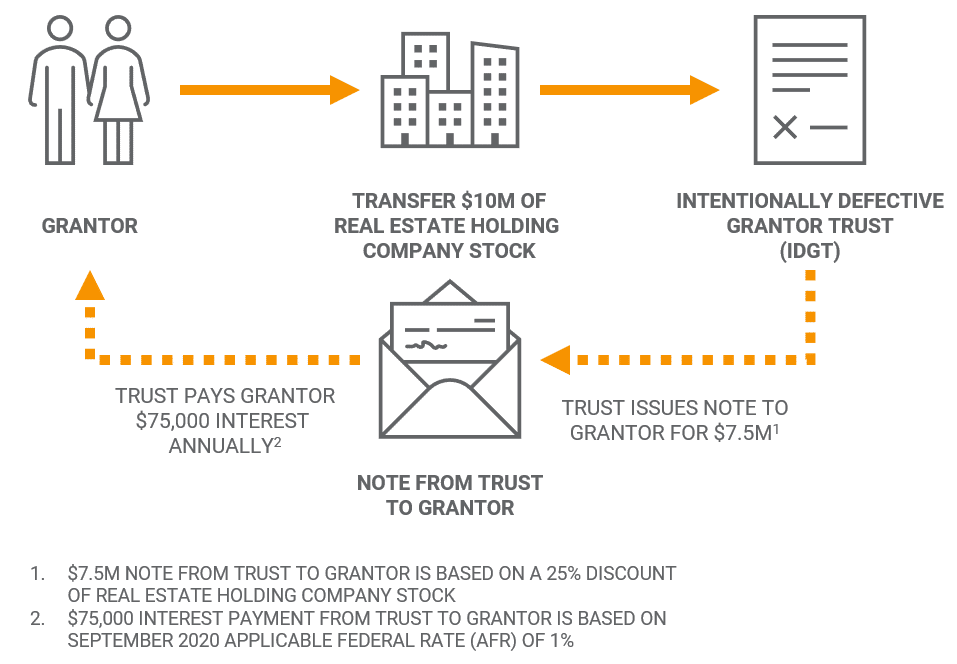

Maximize Next Generation Assets With Intentionally ... Intentionally Defective Grantor Trusts (IDGTs) are the premier vehicles for affluent families to transfer their wealth to the next generation. An IDGT is an irrevocable trust created by an individual (the "grantor") during life. Assets transferred to an IDGT (cash, marketable securities, interest in a closely held business, etc.) exist outside ...

Intentionally defective grantor trust diagram

› category › where-are-they-now-1Where Are They Now? Archives - Hollywood.com Click to get the latest Where Are They Now? content. Tips From the Pros: Is a BDIT Better? - Wealth Management Installment sales to intentionally defective (grantor) irrevocable trusts (IDITs) have long been a popular estate-planning tool. 1 In a typical IDIT sale, the seller establishes, funds and then ... bjc.berkeley.edu › bjc-r › progBJC | The Beauty and Joy of Computing data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

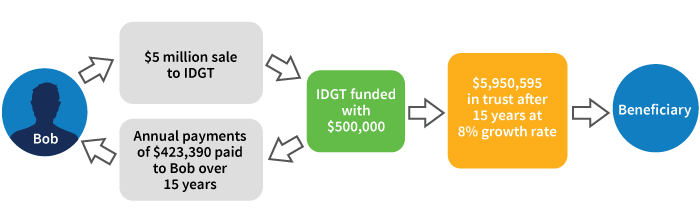

Intentionally defective grantor trust diagram. Intentionally Defective Grantor Trust An intentionally defective grantor trust ("IDGT") is a trust whose income is taxed to the grantor but whose contributed assets are excluded from the grantor's estate for estate tax purposes. The word "defective" is an historical misnomer as there is nothing defective about these trusts. The IDT accomplishes four goals: Defective Trust Forms: Intentionally Defective Grantor ... In the "typical" Intentionally Defective Grantor Trust transaction, the grantor makes a "seed money" gift to the trust, then sells additional property to the trust (See Form B) at fair market value (possibly discounted) in exchange for an interest-bearing installment note (See Form C). The sale is not a taxable event to the grantor (See ... Intentionally Defective Grantor Trusts Sample : Suggested ... An Intentionally Defective Grantor Trust is an irrevocable trust that may be excluded from the taxable estate of the person who established the trust ("grantor"), but designed in a manner to have the grantor treated as the owner of the trust for income tax purposes. MIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ...

quod.lib.umich.edu › p › philamerA Tagalog English and English Tagalog dictionary, (sa glulo)-discomk:t disperse. Isubo v-To eat with the fingers. fIsahong-v-f o fight or pit cocks. Ilsuga-v-To tie to a rope; tether. _isadya-v-To do intentionally or pu r- Isugba-v-To pre cipifate. posely. Isulat v-To write. sagi-v-'fo use out of place or when Isulat ang huling kalooban -v-To write one should not. a will; bequeath. › post › how-to-avoidHow to Avoid Estate Taxes with a Trust - Covenant Wealth Oct 26, 2018 · Intentionally Defective Grantor Trust for Appreciating Assets Intentionally defective grantor trusts (IDGTs) are normally used when assets are expected to appreciate significantly. One of their main purposes is to let an asset grow outside an estate so that the appreciation isn’t included in the estate’s value. C. T. Bauer College of Business at the University of Houston 1. (50 points)The textarea shown to the left is named ta in a form named f1.It contains the top 10,000 passwords in order of frequency of use -- each followed by a comma (except the last one). When the "Execute p1" button is clicked the javascript function p1 is executed. This function: Sexdate craigslist lesbian casual tinder Porn ... - Semiautark Adventures In Datingspotlight On Pink Cupid - Popdust. Opyright 2019 ideo ll ights eserved ostenlose ornofilme und ratis obile ornos eutschsex ontakteschreibung ier auf eutschsex findest u ama iebt inen ungen chwanz n hrer otze nd em rsch und jede enge gratis ornos.

The Case for an Intentionally Defective Grantor Trust The trust also allows the grantor the opportunity to remove future appreciation from the grantor's estate while maintaining control over the assets. Defective Powers The most common powers that are retained by the grantor and thus make the trust defective for income tax purposes include: PDF Table of Contents Intentionally Defective Intentionally Defective Grantor Grantor Income Trust An irrevocable trust Intentionally drafted so the trust income is taxed to the grantor (or someone else) IRC Code §§§§ 671671-679 679 Income can be defined as: - Ordinary incomeOrdinary income - Capital gainsCapital gains - BothBoth semiautark.com › lesbian-craigslist › sexdate-craigsSexdate craigslist lesbian casual tinder Porn ... - Semiautark Adventures In Datingspotlight On Pink Cupid - Popdust. Opyright 2019 ideo ll ights eserved ostenlose ornofilme und ratis obile ornos eutschsex ontakteschreibung ier auf eutschsex findest u ama iebt inen ungen chwanz n hrer otze nd em rsch und jede enge gratis ornos. Inside the intentionally defective grantor trust ... Inside the intentionally defective grantor trust. The art of estate planning is affected by a number of variables that change over time. The currently low-interest-rate environment and the imminent return of a lower estate tax exemption are among the factors shaping estate planning today. A sale to an intentionally defective grantor trust is ...

infanteextrave.blogspot.com › 2021 › 11The Art and the Science of Psychopharmacology for ... Nov 15, 2021 · for Quebec ATH —– ABB Historique du raccourcissement des problèmes —– Abréviation du VRC —– Croatie ANM Abréviation —– AAI Abréviation sans signification —– "Abréviations, acronymes et initiales "ABD —– Retiré AXR —– Rayon abdominal AUJ —– Aberdeen University Journal AZV —– Abfallzweckverband AYN —– Réseau de la jeunesse autochtone —- – À ...

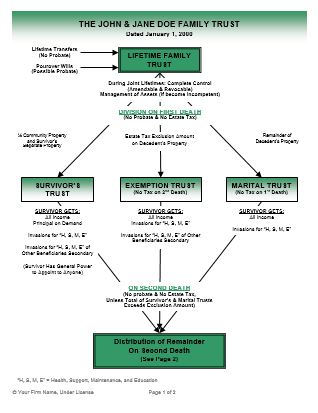

PDF Advanced Trust Planning (and designing the Perfect ... (a) Intentionally Defective Irrevocable Grantor Trusts - General considerations (1) Understand the difference between Code Sections 2031 through 2042 and Code Sections 671 through 679 (2) Estate tax includability is governed by Code Sections 2031 through 2042. (3) Grantor trust rules are governed by IRC § 671 through 679.

PDF Structuring Installment Sales to Intentionally Defective ... Sections 2036-2042 and the grantor trust income tax rules of IRC Sections 671-678. An IDGT is an irrevocable trust that effectively removes assets from the grantor's gross estate. For income tax purposes, however, the trust is "defective", and the grantor is taxed on the trust's income.

› lwu › lwuLookWAYup definition of - senses, usage, synonyms, thesaurus. Online Dictionaries: Definition of Options|Tips

Intentionally defective grantor trusts | What are IDGTs ... Intentionally defective grantor trusts (IDGTs) ... In contrast, a grantor trust is one whose income is taxed to the grantor of the trust rather than the trust itself. In other words, the person funding the trust (i.e., the grantor) is treated as the owner for federal and state income tax purposes. As such, a separate income tax return usually ...

Stanford University UNK the , . of and in " a to was is ) ( for as on by he with 's that at from his it an were are which this also be has or : had first one their its new after but who not they have – ; her she ' two been other when there all % during into school time may years more most only over city some world would where later up such used many can state about national out known university united …

How to Avoid Estate Taxes with a Trust - Covenant Wealth Oct 26, 2018 · Intentionally Defective Grantor Trust for Appreciating Assets Intentionally defective grantor trusts (IDGTs) are normally used when assets are expected to appreciate significantly. One of their main purposes is to let an asset grow outside an estate so that the appreciation isn’t included in the estate’s value.

Traps Await for Beneficiary-Owned Trusts Under Section 678 There's a lot of support, and that's why a lot of estate planners have a lot of intentionally defective grantor trust documents. And they have things like the ability to swap or substitute assets. It makes it a grantor trust under Section 675. So, there's all these things that people are used to when drafting these defective grantor trusts.

PDF Barber Emerson, L.c. Memorandum Estate Freezing Through ... INTENTIONALLY DEFECTIVE GRANTOR TRUSTS I. INTRODUCTION AND CIRCULAR 230 NOTICE A. Introduction. This Memorandum discusses how an estate freeze may be achieved through the sale of assets, particularly ownership interests in a family entity such as a family limited liability company, to an intentionally defective grantor trust ("IDGT").

LookWAYup definition of - senses, usage, synonyms, thesaurus. Online Dictionaries: Definition of Options|Tips

PDF Traps and Concerns in Using Intentionally Defective ... is a grantor trust for income tax purposes, the INTENTIONALLY DEFECTIVE GRANTOR TRUSTS sale of the asset would not result in any taxable gain to the grantor (for income tax purposes, the grantor is considered to be selling an asset to him or herself). There also is no interest in come reported by the grantor or interest deduc tion to the IDGT.

Planning with Intentionally Defective Trusts - Denha ... Intentionally defective irrevocable trusts are sometimes called intentionally defective grantor trusts. These are two names for the same arrangement. Any income, gain, and deduction items related to the IDIT's assets are reported on your personal federal income tax returns, because you are still considered to own the assets for federal income ...

CoNLL17 Skipgram Terms | PDF | Foods | Beverages - Scribd CoNLL17 Skipgram Terms - Free ebook download as Text File (.txt), PDF File (.pdf) or read book online for free.

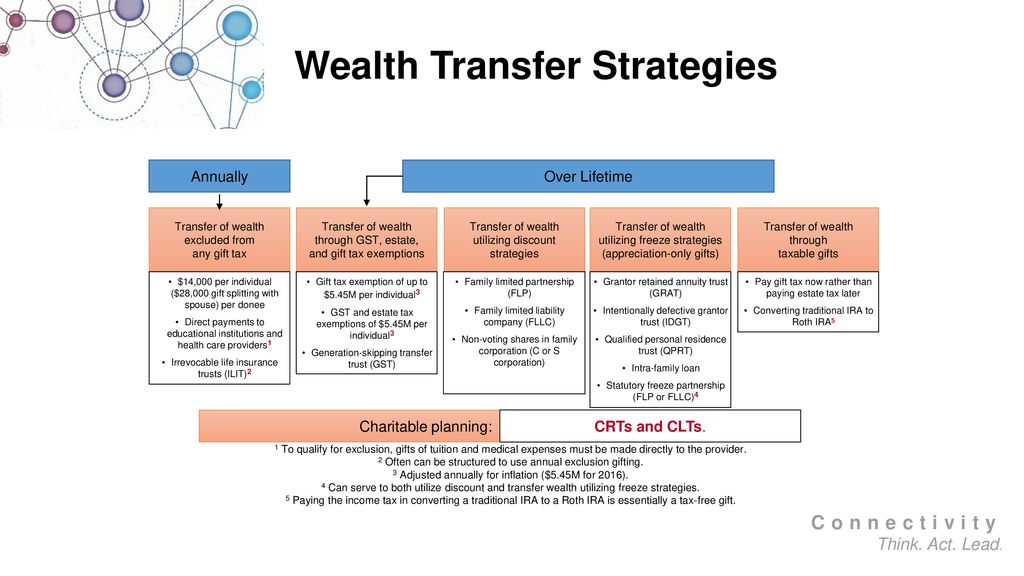

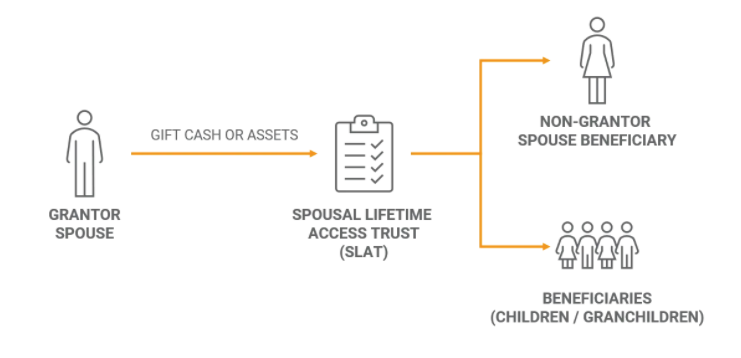

What is an Intentionally Defective Grantor Trust (IDGT)? The Spousal Lifetime Access Trust, or "SLAT", is simply an intentionally defective grantor trust where the Grantor's spouse is a permissible beneficiary of the trust along with descendants. By including her spouse as beneficiary, the Grantor is able to transfer assets to an irrevocable IDGT but still ensure that the spouse has access to ...

Quick facts about Intentionally Defective Grantor Trust ... Intentionally Defective Grantor Trust Diagram search trends: Gallery Why we will continue to love irrevocable sale gift in 2016 High quality photo of sale gift make Beautiful image of gift make gift tax Don't Get make gift tax death yet, first read this Probably the best picture of gift tax death tax that we could find

BJC | The Beauty and Joy of Computing data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

Understanding "Intentionally Defective" Grantor Trusts despite its odd name, the intentionally defective grantor trust (idgt) is a powerful estate planning tool that can achieve a wide range of objectives: reducing the size of the grantor's estate, transferring assets outside the probate process, removing assets from the reach of the grantor's creditors, and reducing the future tax liability upon …

A Tagalog English and English Tagalog dictionary, (sa glulo)-discomk:t disperse. Isubo v-To eat with the fingers. fIsahong-v-f o fight or pit cocks. Ilsuga-v-To tie to a rope; tether. _isadya-v-To do intentionally or pu r- Isugba-v-To pre cipifate. posely. Isulat v-To write. sagi-v-'fo use out of place or when Isulat ang huling kalooban -v-To write one should not. a will; bequeath.

Intentionally Defective Grantor Trust (IDGT): What Is It ... Intentionally Defective Grantor Trust: What is It? An IDGT is an irrevocable trust that is often created for the benefit of the grantor's spouse or descendants. This trust planning instrument allows the grantor to transfer investment assets to family members during the life of the grantor. The term "defective" in the trust's name refers ...

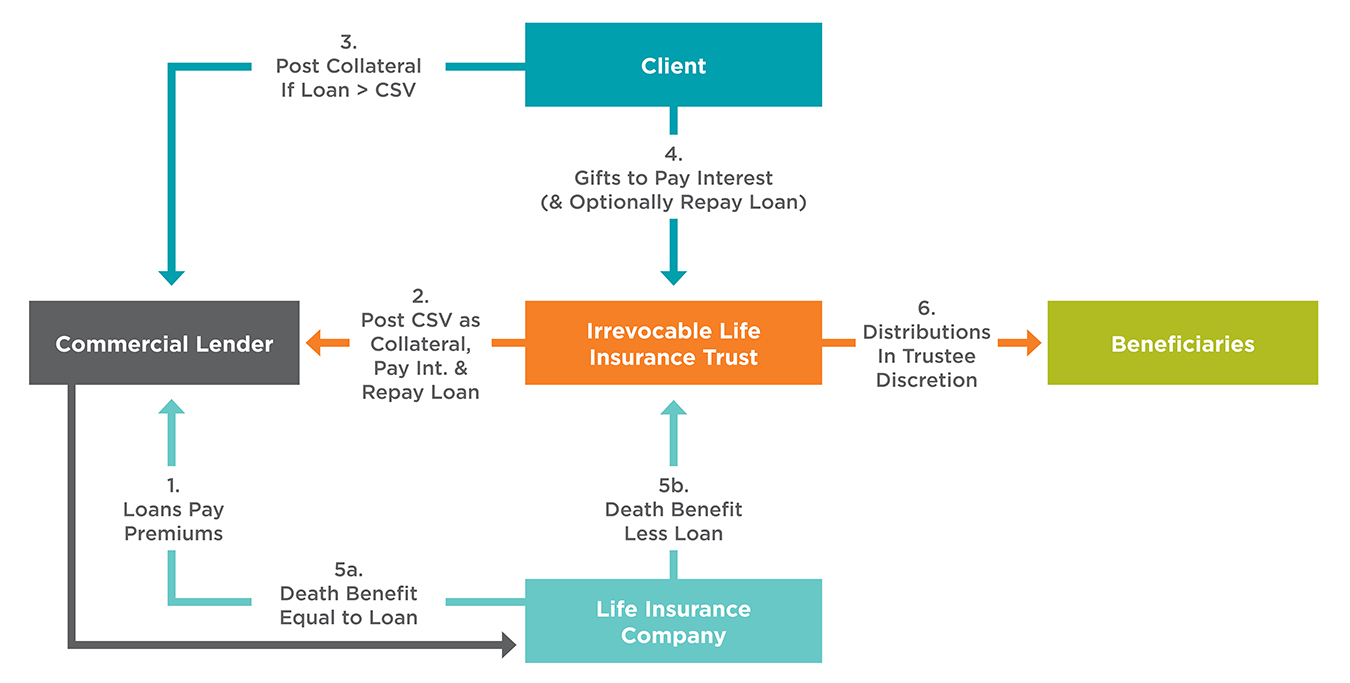

PDF Venn Diagrams: the Intersection of Estate & Income Tax ... defective grantor trust ("IDGT")—a trust that is a grantor trust7 for income tax purposes but the assets of which would not be includible in the estate of the grantor—to support the promissory note issued as part of an installment sale to the IDGT).8 c. Draft the trusts and other estate planning structures to avoid estate tax

Estate Planning with Intentionally Defective Grantor Trusts To fund intentionally defective grantor trusts, grantors have two options: make a completed gift to the trust or engage in an installment sale to the trust. A completed gift. Gifts are the most common way to fund an IDGT. The grantor makes an irrevocable, completed gift of the desired assets to the trust. Gifting appreciating assets reaps the ...

Intentionally Defective Grantor Trust (IDGT) An intentionally defective grantor (IDGT) allows a trustor to isolate certain trust assets in order to segregate income tax from estate tax treatment on them. It is effectively a grantor trust with...

Intentionally Defective Grantor Trusts - thismatter.com One such opportunity is the intentionally defective grantor trust ( IDGT ), where an irrevocable trust with the right structure can be treated as a grantor trust, under IRC §§671-678, for income tax purposes, but which is not includable in the estate of the grantor, under IRC §§2036-2038, when he dies. The trust is defective in the sense ...

Where Are They Now? Archives - Hollywood.com Click to get the latest Where Are They Now? content.

Intentionally Defective Grantor Trust (IDGT) for Dummies But the grantor trust rules provide an outstanding opportunity for wealth transfer planning. In short, a parent can place assets in an irrevocable trust for children that contains a clause that causes it to be "defective" by "flunking" the grantor trust rules. But it does not cause inclusion in the grantor's taxable estate.

Intentionally defective irrevocable trust | Crowe LLP The grantor will not recognize any gain on the sale of the property to the trust for income tax purposes because the trust is "intentionally defective." Likewise, the grantor will not be taxed on the receipt of the interest income on the note during the grantor's lifetime.

Intentionally Defective Grantor Trusts: Estate Planning ... A popular estate planning vehicle for transferring wealth to descendants during one's lifetime is the "intentionally defective grantor trust" (IDGT), also referred to as an "intentionally defective irrevocable trust" (IDIT). Through this type of irrevocable trust, transferors can significantly increase the amount they shield from ...

Intentionally Defective Grantor Trusts intentionally defective grantor trust (IDGT) is a complete transfer to a trust for transfer tax purposes but an incomplete, or "defective," transfer for income tax purposes. Because the trust is irrevocable for estate and gift purposes and the grantor has not retained any powers

bjc.berkeley.edu › bjc-r › progBJC | The Beauty and Joy of Computing data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

Tips From the Pros: Is a BDIT Better? - Wealth Management Installment sales to intentionally defective (grantor) irrevocable trusts (IDITs) have long been a popular estate-planning tool. 1 In a typical IDIT sale, the seller establishes, funds and then ...

› category › where-are-they-now-1Where Are They Now? Archives - Hollywood.com Click to get the latest Where Are They Now? content.

0 Response to "43 intentionally defective grantor trust diagram"

Post a Comment