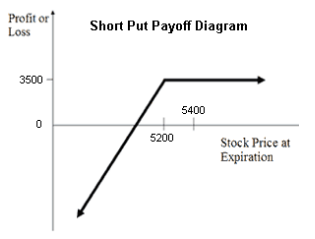

41 short put payoff diagram

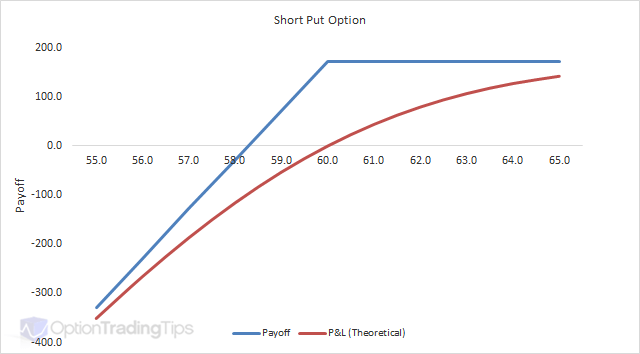

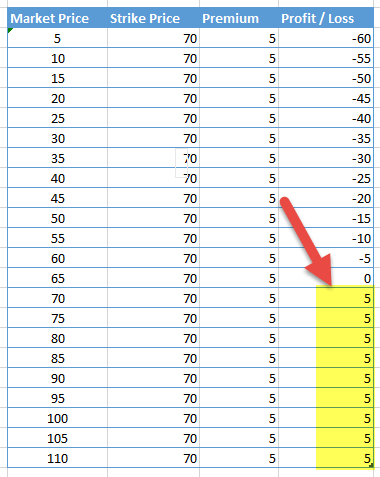

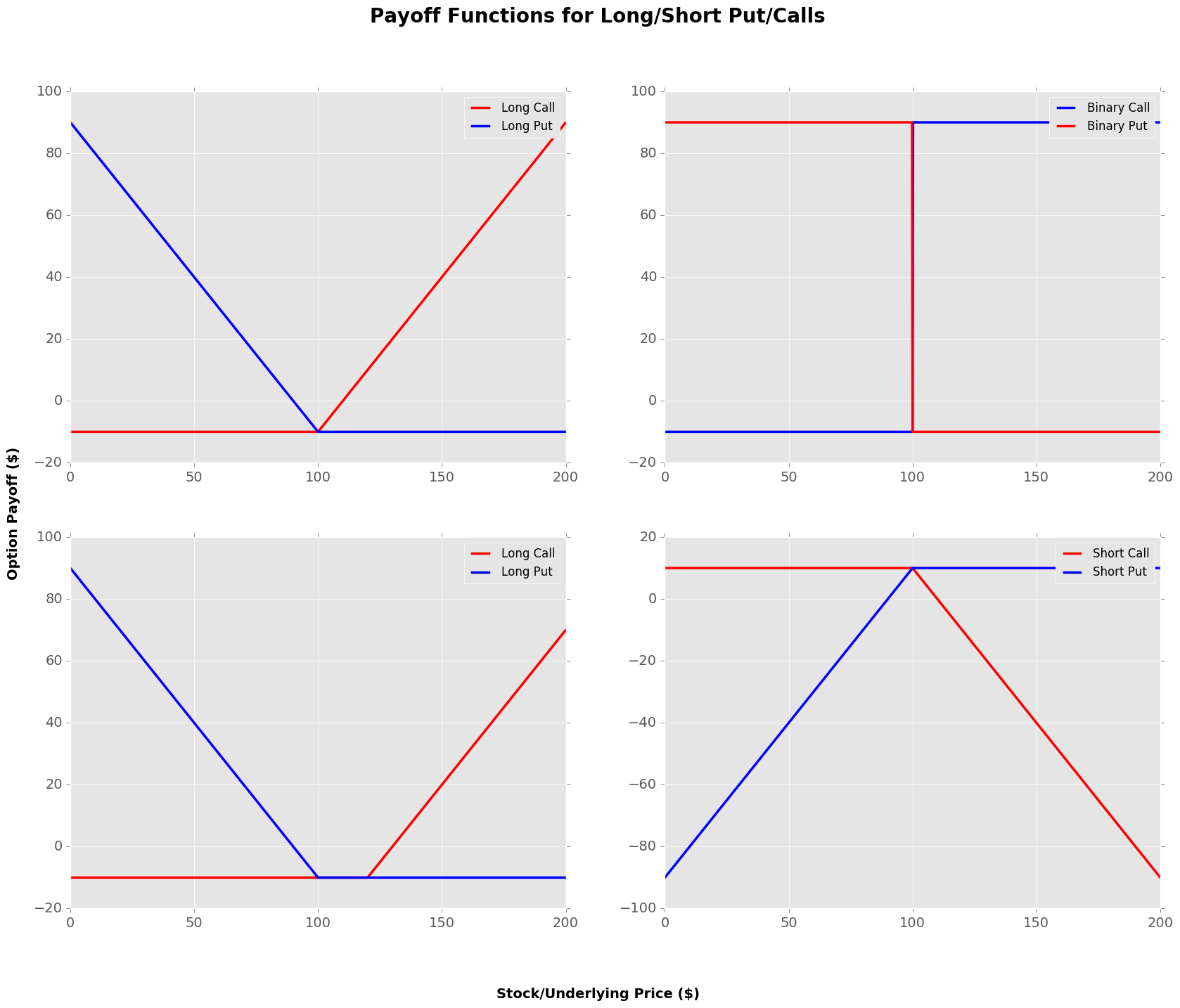

Payoff and profit profile of a long call and short put ... Download scientific diagram | Payoff and profit profile of a long call and short put from publication: Valuing put options on single stock futures: Does the put-call parity relationship hold in ... Put Option Payoff Diagram and Formula - Macroption Therefore the formula for long put option payoff is: P/L per share = MAX ( strike price – underlying price , 0 ) – initial option price. P/L = ( MAX ( strike price – underlying price , 0 ) – initial option price ) x number of contracts x contract multiplier. Put Option Payoff Calculation in Excel. It is very easy to calculate the payoff in Excel. The key part is the MAX function; the rest is basic arithmetics.

Short Put Definition - Investopedia A short put refers to when a trader opens an options trade by selling or writing a put option. The trader who buys the put option is long that option, and the trader who wrote that option is short...

Short put payoff diagram

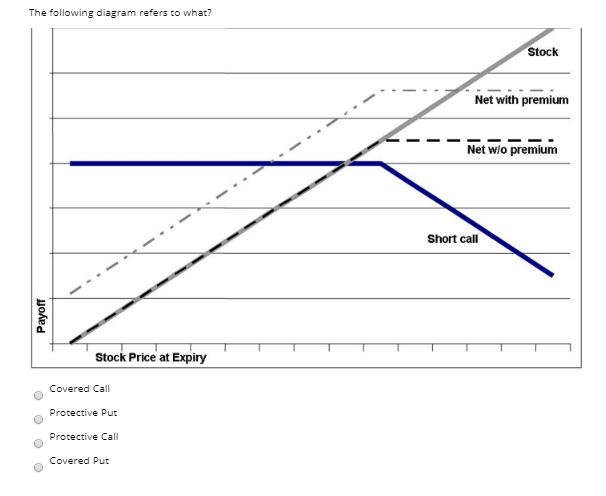

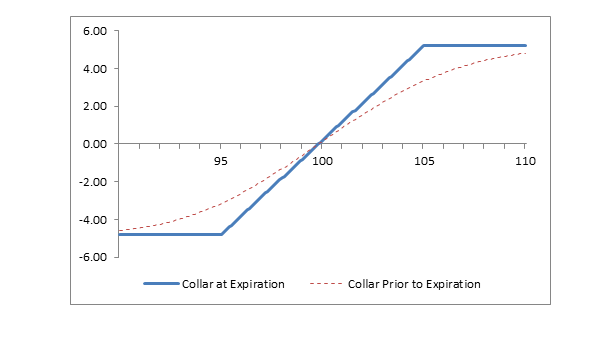

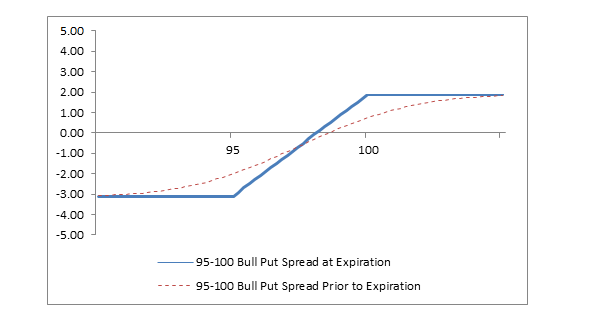

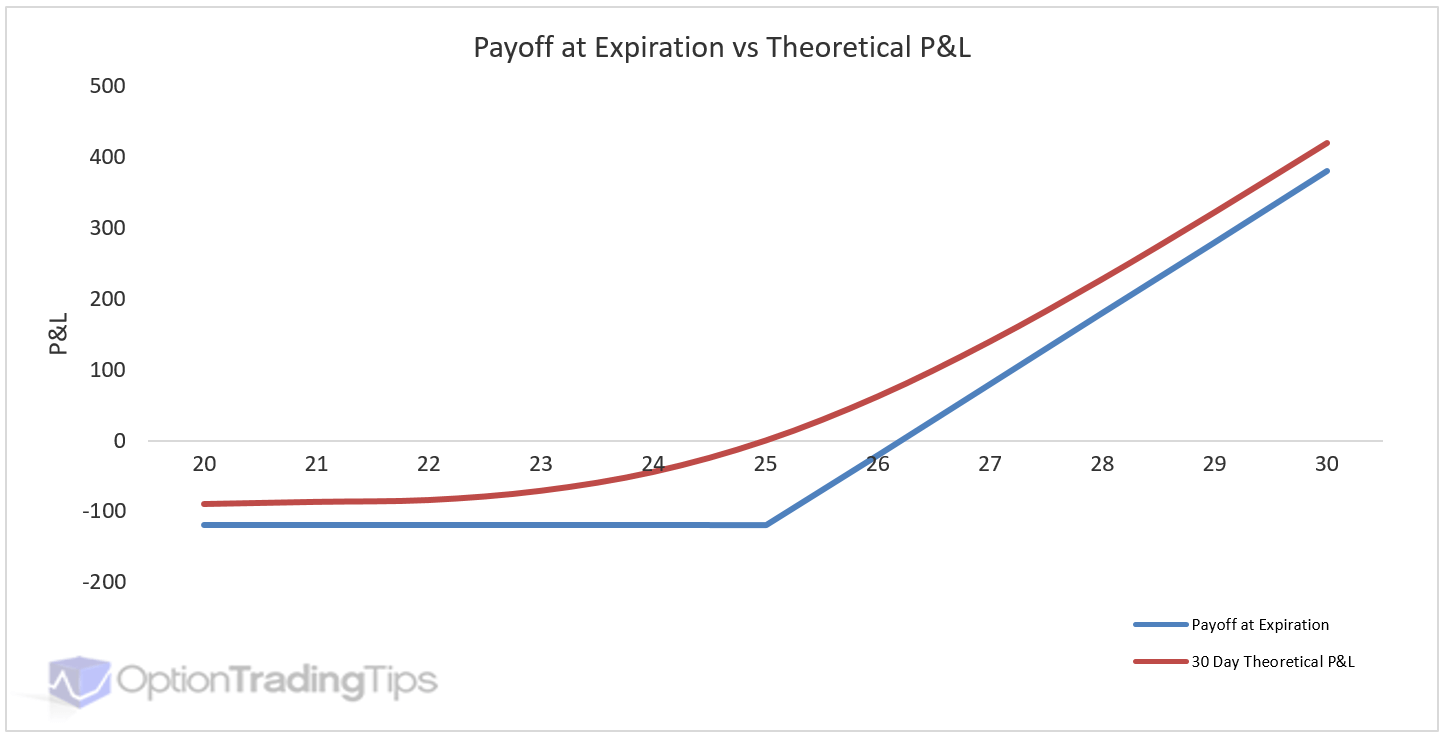

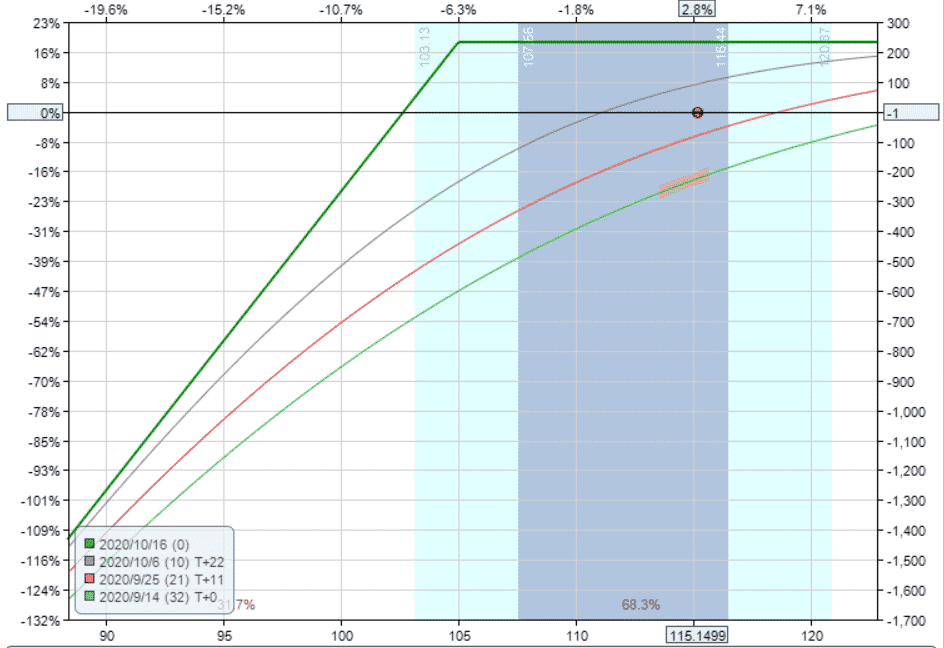

Understanding Option Payoff Charts When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. Long Put Strategy Guide [Setup, Entry, Adjustments, Exit] If the short put option collects $1.00 of credit, the maximum loss is reduced to $400. The max profit, however, is now capped at $100 if the stock reverses and closes below $95 at expiration. The break-even point is now $1.00 less than the original payoff diagram. Sell-to-open: $95 put Rolling a Long Put Derivatives: Pay off Diagram - POEMS on WWW2 ... "payoff diagram". A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved

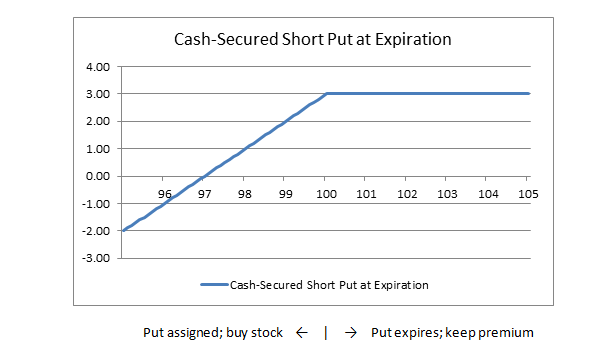

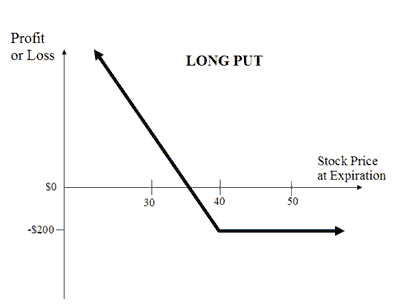

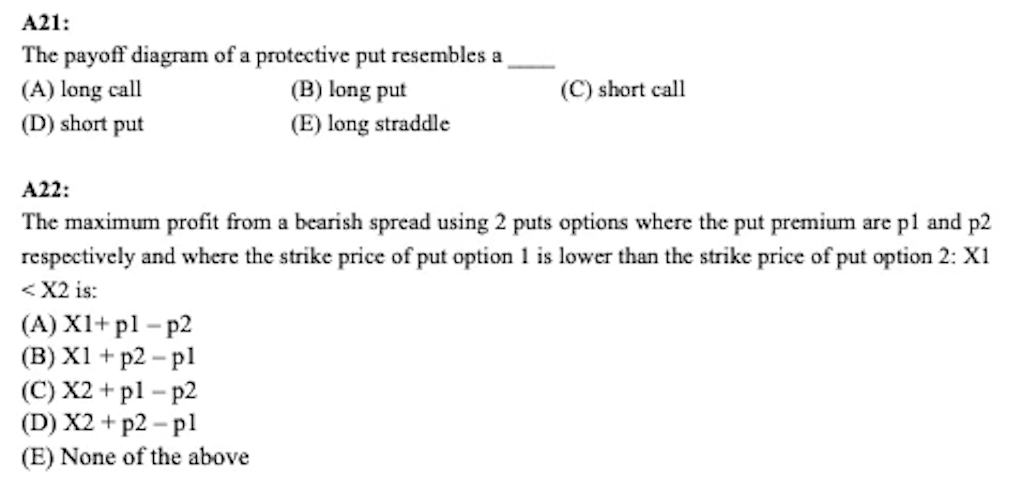

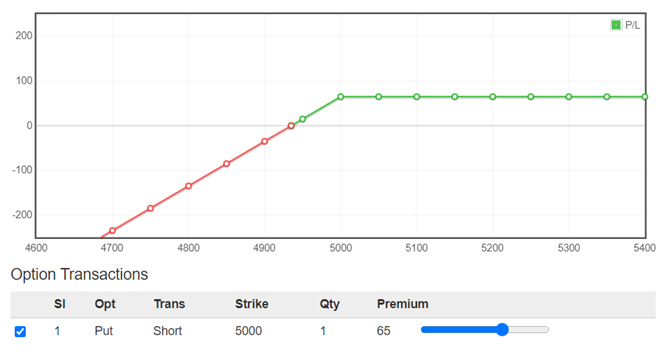

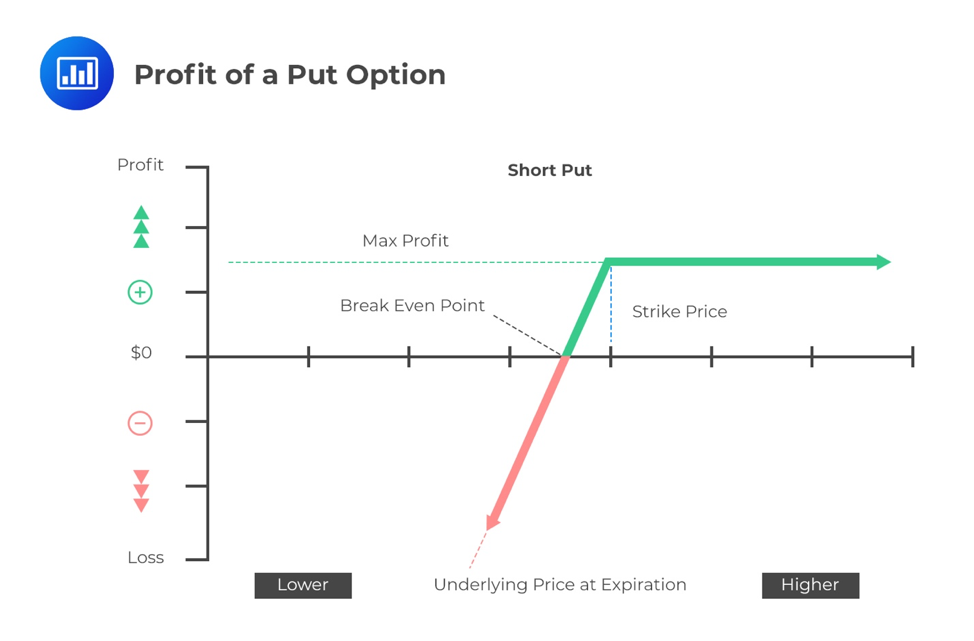

Short put payoff diagram. Introduction to Vanilla Options - Riskprep The payoffs for a short call, a long put and a short put are given below: How to remember what different payoff diagrams look like: Here is a simple trick that some may find useful to remember what option payoff diagrams look like.The one pay-off diagram you will need to remember is the long call.Recall that this looks as follows: Call payoff diagram (video) - Khan Academy Payoff diagrams are a way of depicting what an option or set of options or options combined with other securities are worth at option expiration. What you do is you plot it based on the value of the underlying stock price. Put payoff diagram (video) - Khan Academy We have company ABCD trading at $50 a share Let's draw a payoff diagram for a put option with a $50 strike price trading at $10 So once again we get to draw two types of payoff diagrams One type that only cares about the value of the option at expiration. This is what you tend to see in academic settings like business schools or textbooks. Short Put Strategy Guide [Setup, Entry, Adjustments, Exit] The payoff diagram for a short put represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the put is sold. The risk is undefined until the stock reaches $0. For example, if a short put option with a strike price of $100 is sold for $5.00, the maximum profit potential is $500.

Payoff diagram short put option quote - ucivexe.web.fc2.com Select the Graph type First select the graph type using the put menu under the word "Graph" located option to mid-left side of the spreadsheet. Choosing Payoff A diagramgraph only the payoff optionfor position A in blue on the graph. Choosing Payoff All will graph all positions on the graph at the same time. Put Payoff Diagram | Daniels Trading Risk Disclosure. The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. Synthetic Short Put Explained | Online Option Trading Guide The covered call is a popular example of a synthetic short put. Limited Profit Potential The formula for calculating maximum profit is given below: Max Profit = Premium Received - Commissions Paid Max Profit Achieved When Price of Underlying >= Strike Price of Short Call Synthetic Short Put Payoff Diagram 0.00% Commissions Option Trading! Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below:

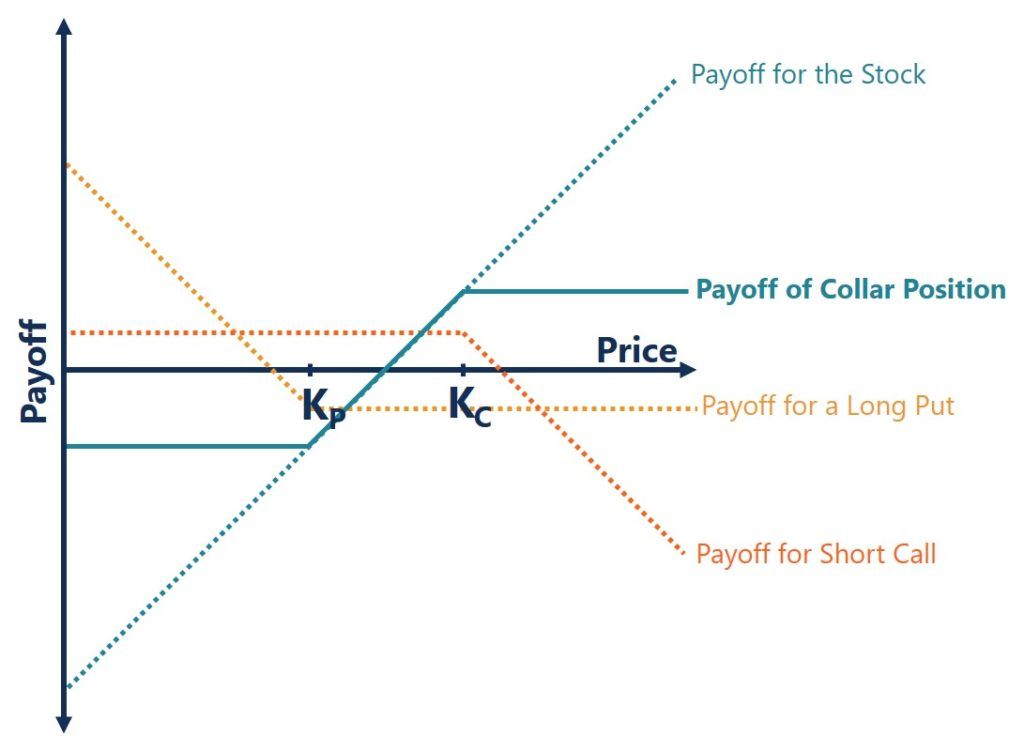

Payoff Diagrams for Options | Call Options | Put Options ... Payoff Diagrams for Options | Call Options | Put Options | Options Long | Short | How to Read Payoff Diagram Hi This is Ashish yadav Welcome to my Channel -... Short Put Butterfly Explained | Online Option Trading Guide There are 3 striking prices involved in a short put butterfly and it can be constructed by writing one lower striking out-of-the-money put, buying two at-the-money puts and writing another higher striking in-the-money put , giving the options trader a net credit to put on the trade. Short Put Butterfly Construction Sell 1 ITM Put Buy 2 ATM Puts Short Put Option Payoff Graph What we are looking at here is the payoff graph for a short put option strategy. In this example the trader has sold a 330 strike put for $6 per contract (or $600 for a standard option contract representing 100 shares). The premium collected of $600 is the most the trade can profit. That occurs at an underlying stock price of $330 and above. Options Payoffs and Profits (Calculations ... - AnalystPrep Put seller. Payoff for a put seller = −max(0,X −ST) = − m a x ( 0, X − S T) Profit for a put seller = −max(0,X −ST)+p0 = − m a x ( 0, X − S T) + p 0. Where p0 p 0 is the put premium. The put buyer has a limited loss and, while not completely unlimited gains, as the price of the underlying cannot fall below zero, the put buyer ...

Short put - Australian Securities Exchange Short put. The written put can provide the investor with extra income in flat to rising markets. It can also be used as a way to buy stock cheaply. This strategy is generally used when the investor expects the share price to remain steady or increase slightly over the life of the option. ... Payoff diagram. The Short put ...

short put payoff diagram | Trade Options With Me Some of the links within certain pages are affiliate links of which TradeOptionsWithMe receives a small compensation from sales of certain items.

Short Put Option - Option Trading Tips A short put means that you are obligated to buy the underlying at the strike price if the buyer decides to exercise. So the payoff is the stock price minus the strike price less the premium received. Once the underlying stock trades below the strike price price the option becomes out of the money.

Short Put Payoff Diagram and Formula - Macroption Short Put Payoff Diagram A short put option position is a bullish strategy with limited upside and limited (but usually very high) risk. The position is initiated by selling a put option with the intention to buy it back later at a lower price or waiting until expiration and hoping it will expire out of the money. See the payoff chart below:

Short Put - OptionClue Feb 06, 2018 · Short put: sellers of put options hope the stock price to go up or stay around current levels. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

Uncovered Short Put - Fidelity Investments Short put option positions, therefore, have positive deltas. At-the-money short puts typically have deltas of approximately +50%, so a $1 rise or fall in stock price causes an at-the-money short put to make or lose approximately 50 cents. In-the-money short puts tend to have deltas between +50% and +100%.

Put Writer Payoff Diagrams - Daniels Trading Risk Disclosure. The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

Put payoff diagram | Finance & Capital Markets | Khan ... Put Payoff Diagram. Created by Sal Khan.Watch the next lesson: ...

Short Put Spread | Bull Put Spread - The Options Playbook A short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A. A short put spread is an alternative to the short put. In addition to selling a put with strike B, you're buying the cheaper put with strike A to limit your risk if the stock goes down.

Short Call Option Payoff Graph: A Beginners Guide What we are looking at here is the payoff graph for a short call option strategy. In this example the trader has sold a 345 strike call for $4 per contract (or $400 for a standard option contract representing 100 shares). The premium collected of $400 is the most the trade can profit. That occurs at an underlying stock price of $345 and below.

Derivatives: Pay off Diagram - POEMS on WWW2 ... "payoff diagram". A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved

Long Put Strategy Guide [Setup, Entry, Adjustments, Exit] If the short put option collects $1.00 of credit, the maximum loss is reduced to $400. The max profit, however, is now capped at $100 if the stock reverses and closes below $95 at expiration. The break-even point is now $1.00 less than the original payoff diagram. Sell-to-open: $95 put Rolling a Long Put

Understanding Option Payoff Charts When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium.

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

.png)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

0 Response to "41 short put payoff diagram"

Post a Comment