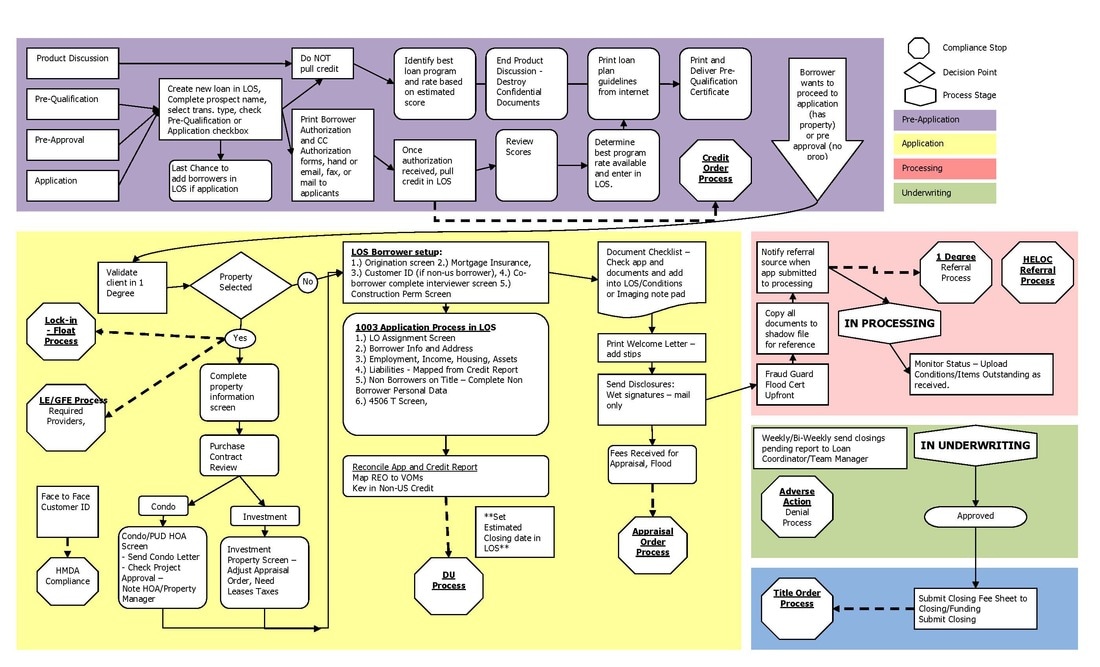

44 loan origination process flow diagram

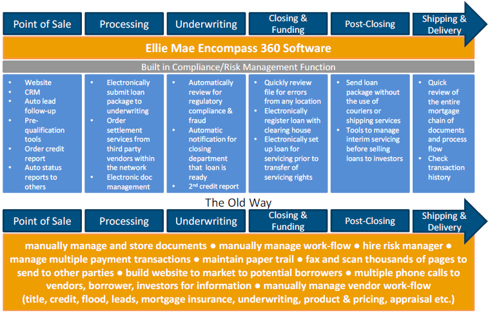

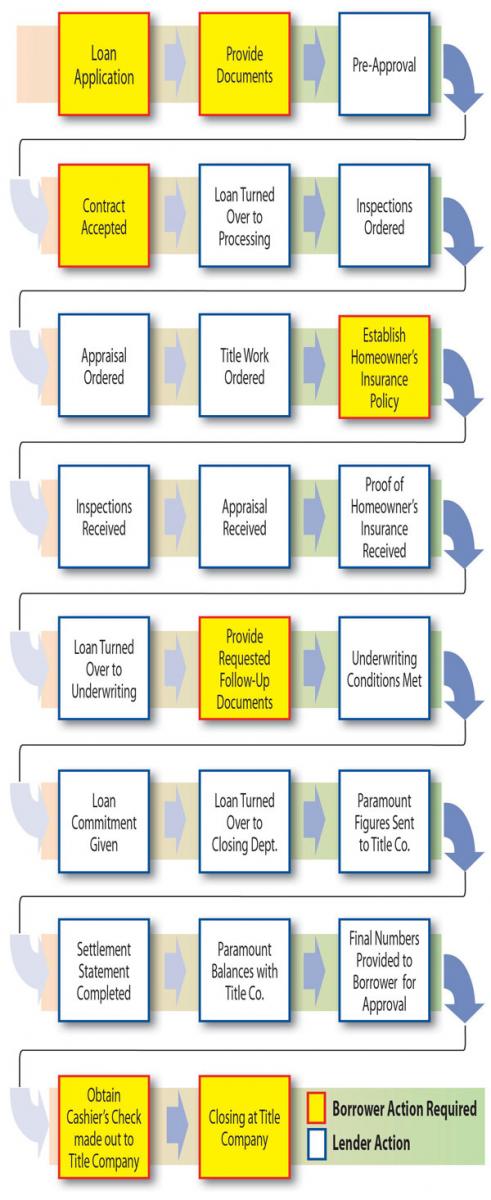

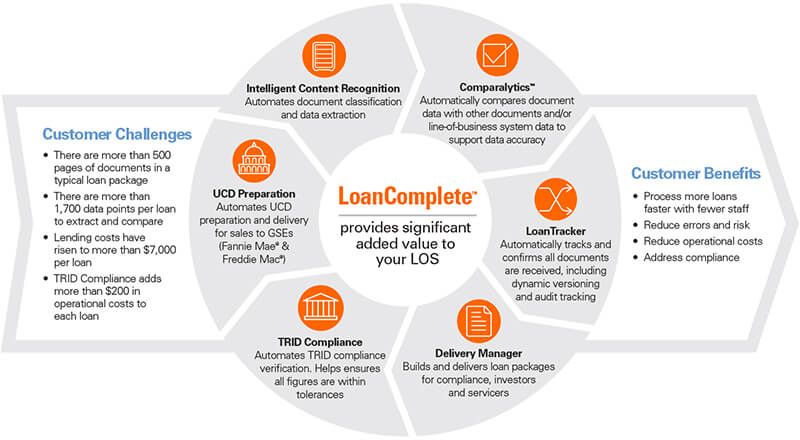

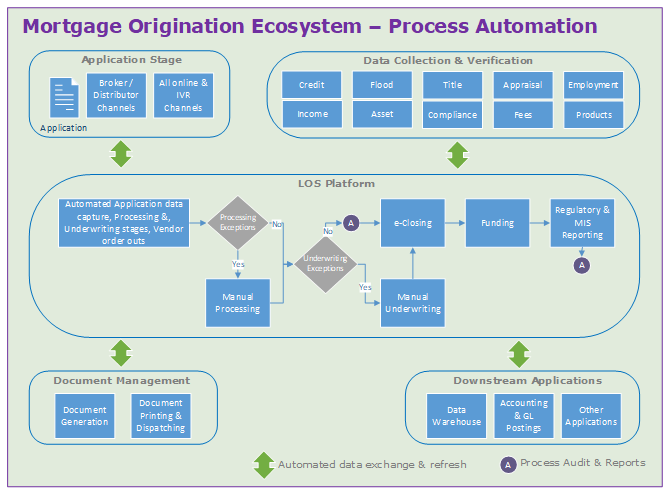

A life-of-loan solution, LoanComplete complements your existing loan origination system workflow, servicing and compliance systems, helping you process and service more loans, at less cost and risk. Address Data Quality and Compliance Challenges so You Can Focus on Growing Your Lending Business 6 Steps of the Mortgage Loan Process: From Pre-Approval to Closing. There are six distinct phases of the mortgage loan process: pre-approval, house shopping; mortgage application; loan processing; underwriting and closing. Here's what you need to know about each step. 1. Mortgage Pre-Approval.

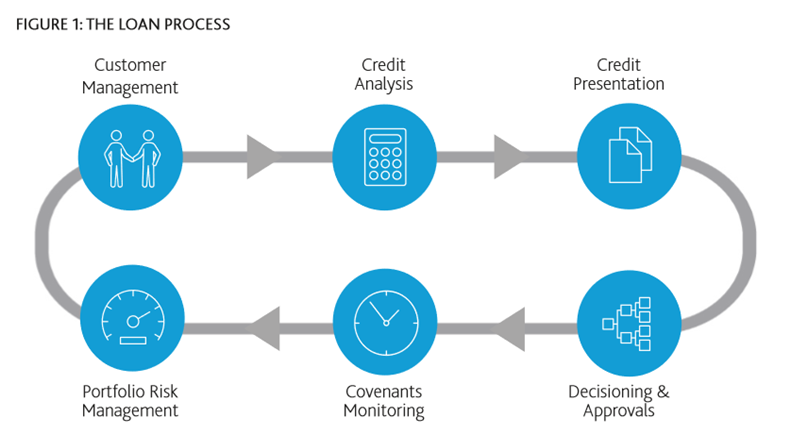

Every process has a life cycle, and so does the process of acquiring a mortgage. It particularly is of vital importance, especially for those who are planning to buy a home. The mortgage life cycle starts when an individual decides to purchase a house and approaches a financial institution for the loan. It continues till the borrower repays the ...

Loan origination process flow diagram

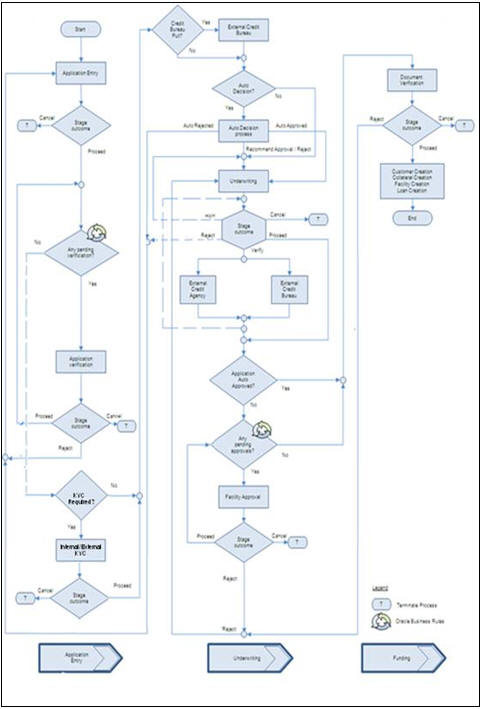

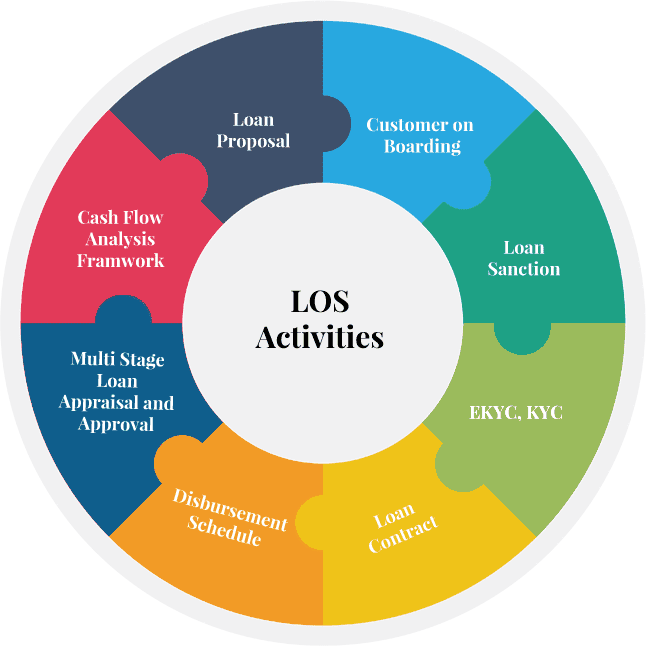

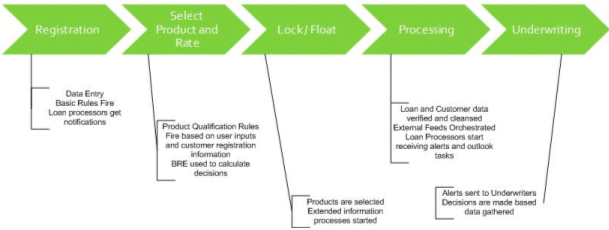

Below are the stages that are critical components of Loan Origination process : 1) Pre-Qualification Process : This is the first step in the Loan origination process. At this stage, the potential borrower will receive a list of items they need to submit to the lender to get a loan. loan information and instructions from the front office to the back office. For practical reasons, mechanization of the commercial lending cycle commenced at the point of origination into the loan operations servicing system. Opinion on data integrity is divided between the origination and servicing functions in the Loan origination typically begins with a bank setting up the borrowing entity in the origination software and ends with the loan being either approved or rejected. Throughout this process, multiple teams from different business units, sometimes located in different offices or cities, need to get involved on a selective basis to do specific tasks.

Loan origination process flow diagram. Loan Application Process. Use Creately's easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. You can edit this template and create your own diagram. Creately diagrams can be exported and added to Word, PPT (powerpoint), Excel, Visio or any other document. Conducted workflow, process diagram and gap analyses to derive requirements for existing systems enhancements. Gathered and refined business requirements for a new auto loan origination implementation project. Write Technical System specifications for Operational, Legal and Compliance enhancements or changes in Empower. The mortgage loan origination process flow begins when a borrower fills out an application. These days, those applications are almost always digital, but the rest of the borrowing experience may not be. If it is, it's usually not part of an end-to-end system that seamlessly connects that first application with the rest of the process. We're ... 1) Pre-Qualification Process : This is the first step in the Loan origination process. At this stage, the potential borrower will receive a list of items they need to submit to the lender to get a loan. This may include : • ID Proof / Address proof: Voter ID, AADHAR, PAN CARD. • Current Employment Information including Salary slip.

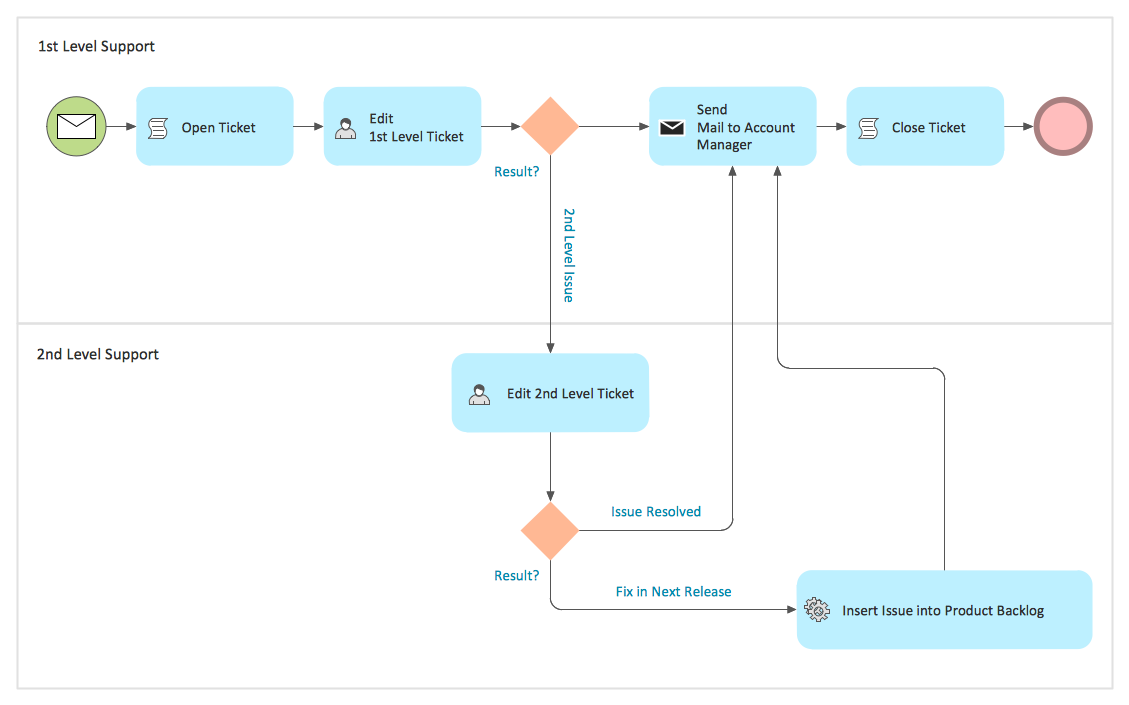

Process flow diagram of Personal loans process. --. You can edit this template on Creately's Visual Workspace to get started quickly. Adapt it to suit your needs by changing text and adding colors, icons, and other design elements. Easily export it in PNG, SVG, PDF, or JPEG image formats for presentations, publishing, and printouts. A process map then takes those steps, diagrams everything visually and identifies any needed improvements. The Mortgage workflow mapping helps lenders to understand the end-to-end process, including people, workflow, and technology, to address operational, and technology gaps. Mortgage flow charts can be used to prepare for automation or ... Charter Pacific Lending Corp. is a privately owned mortgage company serving the Southern California region since 2002. The founder, Babak Moghaddam has been opening doors to home buyers since 1989. Charter Pacific Lending Corp. Creation of Loan Automation Application Adewale O Adebayo, Aibangbee Zandra, Lufadeju Oluwatosin & Maradesa Adepeju School of Computing and Engineering Sciences, Babcock University, P.M.B.21244 Ikeja, Lagos, Nigeria Abstract A business objective of providing efficient loan process using technology as an enabler in order to give the

The mortgage loan origination process typically includes all the steps leading up to, and including, the successful closure and funding of a mortgage loan. The process is triggered when a borrower inquires about a loan, or when a lead is generated through the bank's marketing channels. On average, this process takes anywhere from 30 - 60 days. In this video DecisivEdge Senior Vice President Andrew MacDowell, product owner of Lending and Leasing as a Service (LLaaS), talks about 7 stages in the loan... 1. Retail Loan Origination 1.1 Introduction The process of loan origination gets initiated when a prospective customer approaches the bank, with a loan account opening request or when the bank approaches a prospective customer, taking lead from its database. In case of a bank-initiated request, the process moves forward Flowchart on Bank Flowchart Examples ConceptDraw. It helps customer managers to go on those steps one by one without miss any steps and follow up borrowers easily to avoid bad loans. Loan origination process flow diagram. The mortgage origination process is in a period of transition. Flow chart for loan management is a diagram which uses vector symbols to visually depict the managing process.

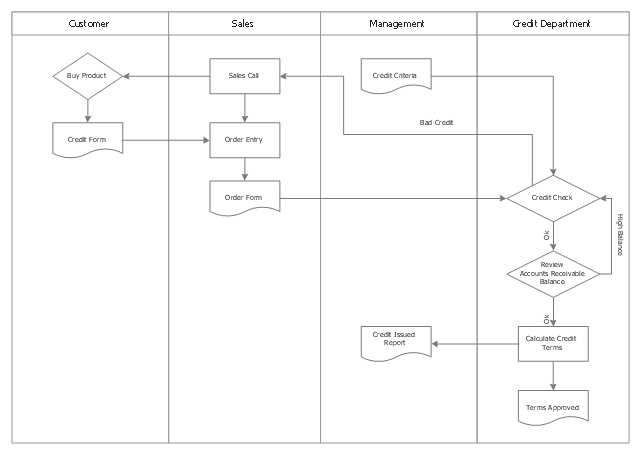

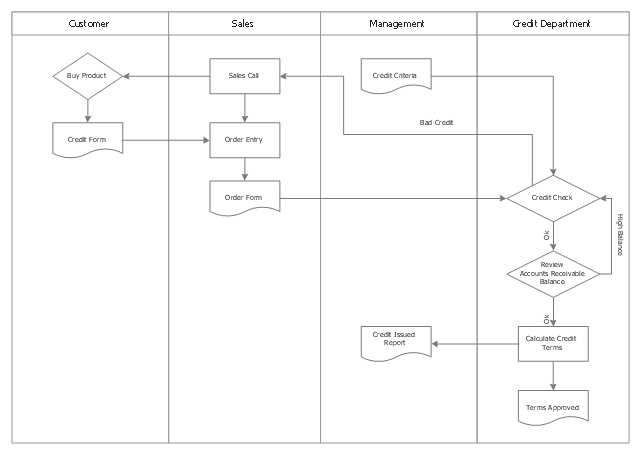

Process Flow Credit Approval Flowchart On Bank Flowchart Examples Business Process Modeling With Conceptdraw Loan Process Flow Chart Swim Lanes

A loan origination system interface module, methods and computer program products. One computer program product for processing loan application data including instructions to extract loan application data including retrieving identification information for a loan application associated the loan application data from a broker device and displaying on the broker device a list of loan ...

Flow chart for loan management is a diagram which uses vector symbols to visually depict the managing process. It helps customer managers to go on those steps one by one without miss any steps and follow up borrowers easily to avoid bad loans. Edraw Flowchart Maker is a professional application for creating flow chart for loan management. Users ...

Loan Process Flow Chart Bankerbroker Com California Home Loans Mortgage Refinance No Doc Mortgages Voe Programs Call 1 877 410 Money

Provides an overview of the paper & digital processes needed to complete financial loan origination. Most institutions are partially manual. LiquidOffice & ...

Process Flow Credit Approval Flowchart On Bank Flowchart Examples Business Process Modeling With Conceptdraw Loan Process Flow Chart Swim Lanes

Looking For Mortgage Loan Origination Process Flow Diagram Current 20 Year Refinance Mortgage Rates Beneficial Mortgage Co Bcu Home Loan Application Form Bay Equity Home Loans Tempe Az Barclays Bank Commercial Mortgages Bdbl Home Loan Bbk Home Loan Banks Greenville Sc Home Equity Loans Best 30 Year Va Mortgage Rates Best 100 Ltv Home Equity Loan .

the mortgage process — from the people involved, to the costs and forms you'll be asked to complete — and how you can take steps to make sure you keep your home long term. Understanding the primary purpose and function of the documents in the mortgage process, as well as the role of the many

FIGS. 1A-1B illustrate an exemplary flow diagram of an exemplary loan origination process, for the case in which the Originator is a real estate broker. FIGS. 2-5C are exemplary screen shots which may be generated by a loan origination system as depicted in FIG. 1.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). For mortgages, there is a specific mortgage origination process.

Loan Origination System Process Ppt Powerpoint Presentation Summary Diagrams Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

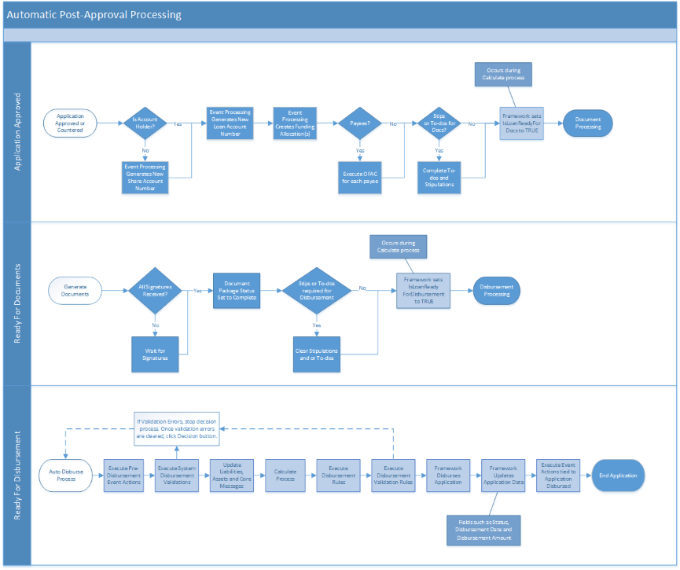

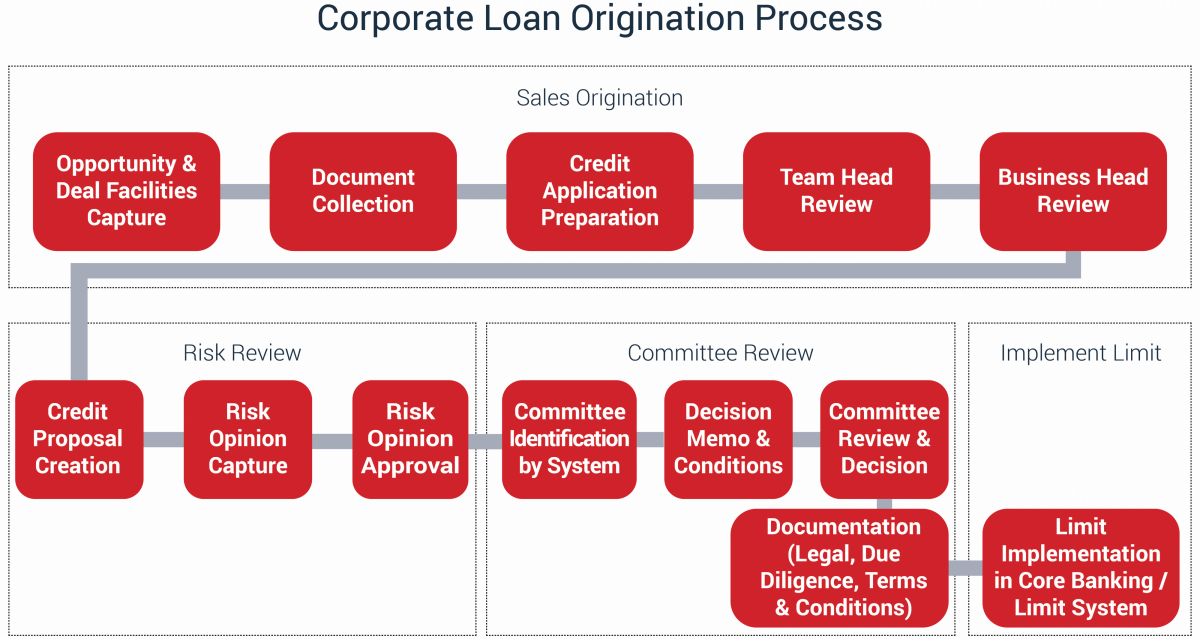

The Corporate Loan origination process flow is composed of following stages: • Application Entry • Application Verification • Underwriting • Loan Approval • Document Verification • Customer, Collateral, Facility, Loan, Account Creation The maintenances and the different stages in the process flow are explained in detail in the

The loan origination process can be paper-based or digital. The digital process includes the entire gamut of the loan origination process with minimal paperwork. The loan origination process can be divided into seven main steps as follows: 1. Pre-qualification process. Pre-qualification is the first step in the loan origination process.

in loan origination (Closing and Funding). Software vendors typically advise customers to start small, perhaps with a project involving exceptions which have to be processed manually. However, the company had already begun a process reengineering effort. In loan origination operations The first project needed to support that effort.

Consumer finance companies carry out similar business processes to banks, but with a focus on loan process flows such as origination, servicing, closing, and more. Process modeling with OpsDog's workflow templates helps companies improve these processes.

Loan origination typically begins with a bank setting up the borrowing entity in the origination software and ends with the loan being either approved or rejected. Throughout this process, multiple teams from different business units, sometimes located in different offices or cities, need to get involved on a selective basis to do specific tasks.

loan information and instructions from the front office to the back office. For practical reasons, mechanization of the commercial lending cycle commenced at the point of origination into the loan operations servicing system. Opinion on data integrity is divided between the origination and servicing functions in the

Below are the stages that are critical components of Loan Origination process : 1) Pre-Qualification Process : This is the first step in the Loan origination process. At this stage, the potential borrower will receive a list of items they need to submit to the lender to get a loan.

Loan Application And Processing Flowchart The Flowchart Explains The Application And Proce Process Flow Chart Template Process Flow Chart Flow Chart Template

Mortgage Policies And Procedures Entire Mortgage Process Documented Mortgage Policies And Procedures Manuals

Loan Origination Process Ppt Powerpoint Presentation Icon Objects Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

A Flowchart Showing Loan Application And Processing Flowchart You Can Edit This Flowchart Using Creately Diagramming T Loan Application Flow Chart Application

Pdf A Workflow Instance Based Model Checking Approach To Analysing Organisational Controls In A Loan Origination Process Semantic Scholar

0 Response to "44 loan origination process flow diagram"

Post a Comment